Do I Need a Business License to Sell Online? Reviewing Most Common Licenses and Permits

Launching a small business online has become increasingly accessible, paving the way for entrepreneurs to enter the eCommerce landscape.

However, this convenience comes with added responsibilities, and understanding the regulatory requirements is vital for success. These prerequisites require online sellers to obtain the necessary licenses and permits to ensure they operate within legal boundaries.

In this article, we’ll answer the essential question that many online businesses have – do I need a business license to sell online?

We’ll explore several types of business licenses for online sellers, navigate the steps to get one, and share the significance of compliance with your local, state, or federal agency.

What Is a Business License?

A business license is an official permit issued by a licensing authority that grants individuals or entities the legal right to operate a business within a specific jurisdiction. This regulatory tool ensures companies comply with local laws, regulations, and safety standards while conducting commercial activities.

When Do You Need a Business License?

A business license is a legal requirement for starting any entrepreneurial journey, including in eCommerce. So, even if you plan to open a small digital business, obtaining the required license is the first step in selling products online legally.

Let’s dive deeper into some instances when you need licensing for small online businesses:

- Starting an eCommerce store. If you’re setting up an eCommerce store, licensing for internet-based businesses is typically required. Some key areas that eCommerce startup regulations cover include data privacy, online advertising, and intellectual property.

- Selling physical or digital products. Whether you’re selling physical goods such as clothes, digital products like online courses, or both, a business license is usually necessary. Even if you’re home-based, you’ll likely need to acquire proper licenses to comply with local regulations, like obtaining a home occupation or zoning permit.

- Operating as a sole proprietorship or an LLC. In both cases, a business license is often mandatory. Aside from distinguishing your eCommerce and personal finances, it ensures proper taxation and regulation.

Operating without a business license can lead to various consequences, like legal action, fines, or penalties. You may face difficulties filing taxes for your eCommerce earnings, leading to tax liabilities and complications.

Lacking a business license could also limit your ability to access legal protection and benefits available to registered businesses. These include limited liability protection for an LLC.

Business License vs Seller’s Permit

While business licenses grant entrepreneurs the authority to operate their businesses legally, a seller’s permit is often necessary for online retailers.

In most cases, you’ll need a business license as one of the legal requirements for selling online.

A seller’s permit becomes necessary when your state requires sales tax collection.

Suppose you sell physical products subject to sales tax, like clothing, electronics, furniture, and sporting goods. Then, it’s crucial to obtain a seller’s permit to remain compliant.

There are also temporary seller’s permits. These permits allow businesses to sell goods or services for a limited duration without obtaining full-fledged, long-term business licenses.

Often known as a temporary vendor’s permit, it’s typically used for short-term or occasional sales events, such as craft fairs, trade shows, pop-up shops, or seasonal markets.

Types of Business Licenses

This section will discuss seven types of business licenses and permits. That said, we strongly recommend researching your local laws to ensure you have the appropriate licenses for your business.

You can typically obtain a business license from your local city or county government office. Processes and requirements vary depending on your business location, so check with your local government’s licensing department or visit their website for detailed information on applying for a business license.

Now, let’s explore some of the most essential business licenses.

General Business License

A general business license, also called a business tax certificate or a business registration certificate, is a fundamental license many online businesses require.

This license provides you with the legal authority to operate within your city or county, ensuring you comply with local and taxation laws specific to your jurisdiction.

General business licenses are used by various types of businesses, from sole proprietorships and LLCs to partnerships and corporations. They’re essential for online companies to establish their legal presence and fulfill local tax obligations.

Professional License

A professional or occupational license is mandatory for individuals and businesses engaged in professions or services that demand specialized skills, qualifications, or certifications. These professions may include doctors, lawyers, architects, and accountants.

This specialized license protects the public by ensuring individuals or businesses offering professional services have the necessary qualifications and competence. Hence, it’s also a form of consumer protection.

Home-Based Business License

A home-based business license, or a home occupation permit, is necessary to run your business from your residence. It ensures your home-based business complies with zoning regulations, safety codes, and local laws.

The primary purpose of this license is to balance the needs of home-based business owners with the concerns of their residential neighbors. It aims to prevent disruptions to the neighborhood, maintain property value, and ensure safety.

There are usually restrictions on the size and scale of home-based businesses. For example, it might limit:

- The number of employees you can hire.

- The amount of space you can use for business purposes.

- The types of activities allowed.

If you’re operating a small online business from your residence, obtaining a home business license legitimizes your operations and addresses potential concerns.

Sales Tax License or Reseller’s Permit

A sales tax license, also referred to as a reseller’s permit or sales and use tax permit, is essential for businesses that sell tangible goods, both physical and digital. It authorizes you to collect or pass the tax money on to the appropriate authorities within your state.

With a sales tax license, charging and collecting sales tax from customers at the time of sale is permissible.

B2B companies may be eligible for sales tax exemptions or discounts. These exemptions are often associated with a separate reseller’s permit or a resale certificate.

With this type of seller’s permit, businesses can buy products or services for resale without paying sales tax at the time of purchase. A reseller permit for online business streamlines the resale process. It ensures that sales tax is only paid once – by the final consumer.

Industry-Specific Licenses

Industry-specific licenses are mandatory for businesses operating in highly regulated sectors, like healthcare, finance, and transportation.

For example, healthcare industry licensing ensures medical clinics, pharmacies, and home services adhere to strict standards. This helps ensure patient confidentiality and safe healthcare practices.

Depending on your online business industry, you may need specific licenses or permits to meet industry-specific regulations and standards.

Important! Don’t confuse professional with industry-specific business licenses.

Professional licenses are typically linked to individuals in specific professions. These licenses focus on their qualifications and conduct, ensuring they meet standards.

In contrast, industry-specific licenses apply to entire businesses operating in regulated sectors, with a primary focus on ensuring compliance with industry-specific regulations and standards.

Both types of licenses serve distinct purposes and are essential for maintaining professionalism and compliance within their respective domains.

Health Department Permits

Health department permits are required for businesses handling food preparation, storage, or distribution. These permits ensure compliance with health and safety regulations to protect public health.

In eCommerce, health department permits are used by food-related businesses like online food delivery services and meal kit subscriptions.

By obtaining health department permits, eCommerce businesses can demonstrate their commitment to food safety. Companies can also reassure customers that their products are prepared and handled with the highest standards of hygiene and quality.

Creative and Artistic Licenses

Creative and artistic licenses are often required for individuals and businesses involved in creative pursuits. These may include licenses for artists, performers, composers, and photographers.

Depending on your artistic field, you may need a specialized license aligning with your creative activities to ensure legal compliance.

These licenses grant you the authorization and rights to pursue and monetize your artistic talents while adhering to regulatory standards and intellectual property laws.

Running a Business Without a License

While various business licenses and seller’s permits exist for legal business operations, there are cases where selling without a business license is possible. Understanding these situations is crucial for ensuring small business administration compliance.

Here are some instances when a license to sell online may not be necessary:

- Freelancing or gig work. Freelancers offering online services like writing, graphic design, or web development may not need a formal license. However, they should report income for tax purposes.

- Hobby selling. If you occasionally sell items from a personal collection or crafts you make as a hobby, you may not need a license. However, if it becomes a regular source of income, an online store permit may be necessary.

- Non-profit organizations. Some non-profit organizations may be exempt from business licensing requirements. However, they often need to register as tax-exempt entities with the IRS.

- Low-revenue threshold. In some jurisdictions, businesses that earn income below a certain threshold may be exempt from licensing requirements. This threshold varies by location.

- Informational websites or blogs. Typically, running a website or blog providing information, educational content, or personal opinions doesn’t require a business license. However, licenses for online advertising or affiliate marketing may be needed.

- Online marketplaces. If you sell products on an established online marketplace, like Amazon or eBay, it will handle licensing and tax collection on your behalf. Be sure to check with your chosen marketplace.

- Charitable activities. Charitable organizations often have their own set of regulations and may not require a traditional business license. However, they must comply with charity laws.

That said, being proactive in understanding and complying with local laws is a fundamental aspect of responsible entrepreneurship.

Regardless of whether you believe your business falls into one of the above categories, it’s crucial to verify if you need local business licenses. Requirements can vary significantly depending on your business location and activities, so check with your local licensing office.

How to Get a Business License to Sell Online

Now that we’ve covered the various types of licenses to conduct business on the internet, let’s explore 10 general steps for obtaining a business license to sell online.

1. Identify Your Online Sales Activities

Clearly define your sales activities before getting into the licensing process, as each product and service has its own requirements.

Let’s say you are selling jewelry through a website and offering shipping to customers across the United States. This activity involves eCommerce and interstate trade, potentially requiring sales tax permits in multiple states.

For an independent artist selling digital art downloads globally, consider copyright licensing agreements. If you’re a business owner providing professional online services, you’ll need to obtain specialized licenses.

Check out these articles to learn more about starting an online business:

How to Start an Online Business

How to Start an Online Store

How to Sell Online Successfully

30 Online Business Ideas

35 Trending Products to Sell

2. Research eCommerce Regulations

Next, research eCommerce license requirements specific to your location. Equally important is understanding the rules governing eCommerce sales in the regions where you plan to operate.

If you intend to sell online in the United States, you must comply with federal government regulations for eCommerce. An example is the Electronic Signatures in Global and National Commerce (E-Sign) Act, which outlines requirements for online contract formation.

On a local level, check the state-specific sales tax laws. Each US state has rules regarding sales tax rates, exemptions, and thresholds for entrepreneurs.

Therefore, if you plan to sell to customers in multiple states, you may need to register for sales tax permits in those states and collect sales tax accordingly.

3. Choose a Legal Structure for Your Online Business

Selecting the appropriate legal structure for your online business is essential. Your chosen structure can influence the business licenses and permits you’ll need.

For a sole proprietor, business licenses and permits typically depend on the products you offer and your location.

Standard requirements include a general business license and a sales tax permit should you generate taxable sales. If you run a small business from your residential property, you’ll also need a home occupation permit.

Unlike a sole proprietor, the business licenses and permits needed for a limited liability corporation (LLC) are more comprehensive.

In addition to a general business license and sales tax permit, you’ll need industry-specific licenses based on your business activities.

Some states might also need you to register an operating or trade name if you don’t use your LLC’s legal name.

Suggested Reading

Check out this article from Hawaii’s Department of Commerce and Consumer Affairs on the differences between a trade name vs business name.

Corporations, whether S or C, also require industry-specific licenses.

For example, those running a medical equipment manufacturing corporation will require industry-specific permits like a Medical Device Manufacturing License, FDA Registration, and ISO Certification.

Moreover, corporations are subject to more stringent compliance requirements at the state and federal levels.

Federal licenses are required for business activities in several fields, including agriculture, commercial fisheries, and nuclear energy. You can check the federal business licenses on the US Small Business Administration website.

4. Register Your Business

Once you’ve determined your legal structure, it’s time to register a business license for online sellers with the appropriate licensing authorities. Here’s a general overview of online business registration:

- Select a unique name for your small business. Check with your state’s business registration office to ensure the chosen name is available and complies with naming regulations.

- Prepare a business bank account. Keeping business and personal finances separate is crucial for legal and tax purposes.

- Register with state authorities. List your online business with state authorities, which usually involves filling out specific forms and paying the necessary fees.

- Obtain an Employer Identification Number (EIN). Often referred to as a Federal Tax Identification Number, it’s required for tax identification purposes. Apply for an EIN on the Internal Revenue Service (IRS) website.

- File necessary reports. Comply with ongoing reporting requirements. Depending on your business structure and location, this may involve annual reports, tax filings, and other regulatory submissions.

5. Determine Sales Tax Obligations

Many online sellers have sales tax obligations. Research whether you need to collect and remit the tax on your eCommerce sales.

The sales tax nexus connects a business and a state. It determines if the company must collect and pay sales tax when selling to consumers in that state.

So, if there’s a strong connection or nexus, the business must follow the state’s sales tax rules.

With the growth of eCommerce, determining the sales tax nexus for online sellers has become more complex.

Many states have enacted economic nexus laws to capture sales made by out-of-state online sellers. This means that even if a company lacks a physical presence in a state, it may still have a nexus based on its eCommerce sales.

6. Apply for an eCommerce Business License

An eCommerce business license is an official authorization required by some local and state governments for businesses engaged in online commerce. It allows such companies to operate legally and conduct online transactions.

Obtaining an eCommerce business license typically involves checking with local and state government agencies. You might also need to complete the necessary application forms and provide any requested documentation to obtain the license.

7. Choose the Right Hosting Provider for Your Online Store

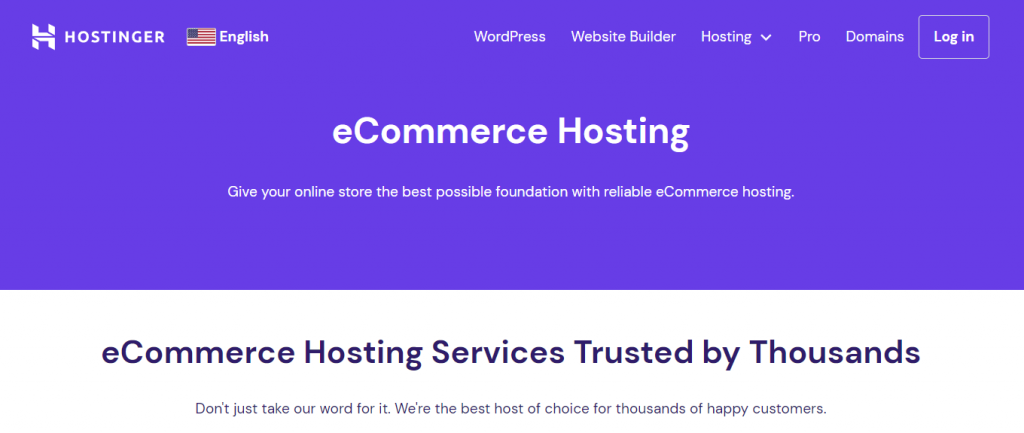

Selecting a reliable hosting provider is crucial for online businesses. A reliable web host ensures your online store is able to comply with eCommerce best practices. It also fortifies your site against downtime, which can lead to customer and revenue loss.

Hostinger’s eCommerce hosting is an ideal solution. The cloud hosting infrastructure enables us to offer 99.9% guaranteed uptime and excellent page load time.

Moreover, we make sure your online store can handle transactions securely and efficiently with unlimited free SSL certificates. Consumer protection and data privacy are also taken care of as we consistently implement the latest security measures.

Some of our key eCommerce hosting features include:

- Seamless eCommerce platform integration. We offer one-click installation for WooCommerce, PrestaShop, and OpenCart as self-hosted eCommerce software.

- Hostinger Website Builder. All plans include our in-house drag-and-drop AI builder, which has secure payment gateways and zero commission fees.

- Global data centers. Ensure optimal performance worldwide by choosing a server closest to your target audience, whether in Europe, Asia, North America, or South America.

- Daily backups. Regularly save your website as a preventive measure. We also have easy restore in case of data loss due to accidents, hacking, or technical issues.

- Staging area. Create an identical copy of your eCommerce store to safely test new features, plugins, or design changes without affecting the live site.

- Performance optimization tools. These include object caching and LiteSpeed Cache for WordPress.

8. Comply with Online Privacy and Security Regulations

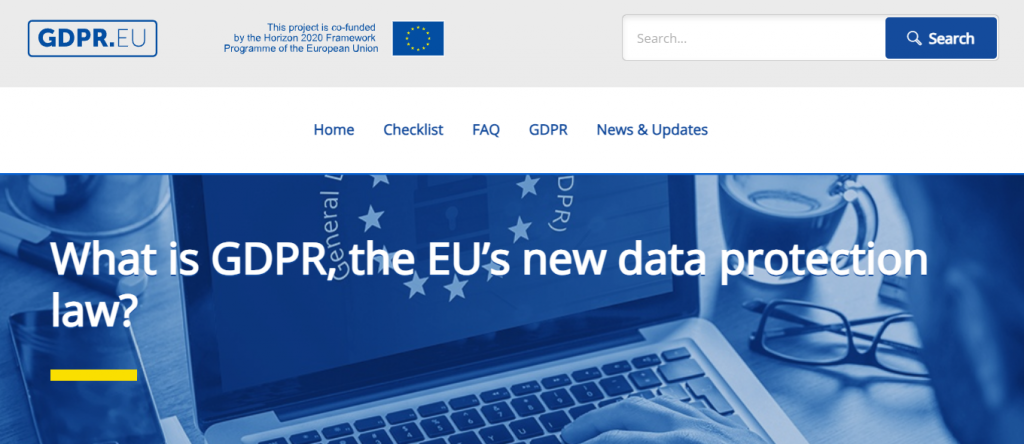

Ensure you are compliant with online privacy regulations such as GDPR or CCPA, if applicable to your business.

General Data Protection Regulation (GDPR) was enacted by the European Union (EU) to safeguard the privacy and personal data of EU residents. It grants individuals more control over their data and requires organizations to be transparent about how they collect, process, and store data.

GDPR imposes strict rules on data protection, consent, and breach reporting. It applies not only to EU-based businesses but also to any organization worldwide that processes the personal data of EU residents.

GDPR violations can result in significant fines, with penalties reaching up to €20 million or 4% of the company’s global annual revenue, whichever is higher.

On the other hand, the California Consumer Privacy Act (CCPA) is a privacy law enacted in California, the United States, to enhance the privacy rights of California residents.

CCPA grants California consumers the right to know what personal information businesses collect. It also allows individuals to request the deletion of their data, opt out of the sale of their data, and receive equal service and pricing when exercising their privacy rights.

CCPA primarily applies to businesses that operate in California and meet the defined criteria. However, its influence extends beyond the state due to the economic significance of California.

CCPA violations can lead to fines imposed by the California Attorney General’s Office, with penalties ranging from $2,500 to $7,500 per violation.

9. Regularly Review and Update Licenses

Note that business licenses and seller’s permits are not static. Periodic reviews and updates ensure ongoing compliance with evolving laws and regulations.

Keeping your licenses up-to-date is crucial to avoid any legal issues arising from outdated permits. Depending on your jurisdiction and sales activities, you may need to renew certain documents annually or at specific intervals.

If your business operation or structure changes, assess whether these new adjustments necessitate updates to your existing licenses.

10. Seek Legal Advice if Necessary

In some cases, you might encounter some legal roadblocks or need clarification on specific digital business license requirements. We recommend consulting with a business attorney specializing in eCommerce for valuable guidance in navigating the legal aspects of an online business.

Benefits of Having a Business License

While the process of acquiring a business license may seem like a bureaucratic hurdle, the advantages it offers can significantly impact your online business’ success and reputation.

Let’s review some benefits:

- Legal compliance. Operating with a valid business license ensures that your online business stays within the law. This legal compliance protects you from potential penalties and establishes your small business as accountable.

- Consumer trust. Displaying your business license prominently on your website or during transactions signals professionalism and reliability to your customers. It fosters confidence that you are a legitimate business, resulting in higher trust and increased sales.

- Access to business resources. Many suppliers, distributors, and wholesalers require organizations to have a valid license to establish partnerships. Holding a business license provides wider opportunities for beneficial professional relationships.

- Financial credibility. Lenders, investors, and financial institutions view small businesses with licenses as more financially stable and reliable. This can make it easier to secure loans, attract investors, or establish credit lines for your online store.

- Tax benefits. A business license enables you to take advantage of potential tax deductions and benefits available to legitimate businesses. It can help you save money on taxes and manage your finances more efficiently.

Conclusion

To sell online legally, business owners must adhere to local, state, and federal regulations. This means obtaining proper licenses and permits and complying with tax responsibilities in their respective jurisdictions.

In eCommerce, a business license grants you the authority to operate a specific type of business in a particular location. Meanwhile, a seller’s permit allows you to collect or remit eCommerce sales tax on purchases made within a given state.

Let’s review the seven types of business licenses and seller’s permits to consider:

- General business licenses. Essential for any digital business to establish its legal presence.

- Professional licenses. Also known as occupational licenses, they are required for businesses providing services online.

- Home-based business licenses. Mandatory for small business owners to operate their activities from home.

- State sales tax licenses. Authorizes businesses to collect and remit sales tax.

- Industry-specific licenses. Required for businesses operating in highly regulated sectors.

- Health department permits. Necessary for demonstrating a commitment to food safety.

- Creative and artistic licenses. Offers the authorization and rights necessary to pursue and monetize artistic talents.

Licensing your online enterprise is the first step in establishing a legitimate and compliant business presence.

On top of that, opt for secure and reliable hosting services to support your eCommerce store’s growth. Explore Hostinger’s eCommerce hosting solutions for a seamless and successful online selling experience.

Do I Need a Business License to Sell Online FAQ

Understanding the requirements for selling online can be complex. Let’s address some common questions to clarify whether you need a business license for your online venture.

Do I Need a Business License to Sell Products Online From Home?

Yes, in many cases, you’ll still need a business license to sell products online from home. The requirement often depends on the location where your business operates, the type of products you sell, and local regulations.

Is an Online Business License Different From a Traditional Brick-And-Mortar Business License?

Yes, online business licensing differs from a traditional business license. Selling on the internet requires specific permits related to eCommerce. Meanwhile, a brick-and-mortar store might deal with physical storefront licensing.

Can I Get a Business License for Selling Products Internationally Online?

Yes, you can acquire a business license for conducting online sales globally. The process may involve additional steps, such as compliance with international trade laws, customs regulations, and tax considerations. It’s essential to research and ensure compliance with the specific countries you intend to sell to.